Last updated on January 20, 2025

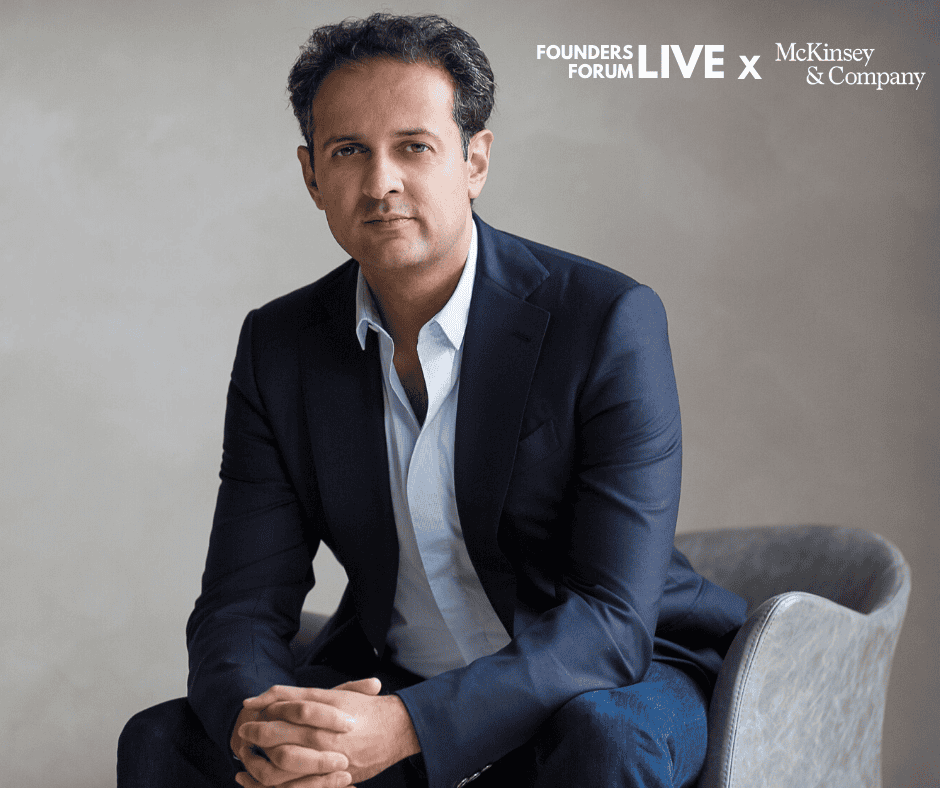

Founders Forum hosted Europe’s fastest growing company for an exclusive fireside chat earlier this month, entitled “FinTechs Adapting to Thrive”. The event featured Rishi Khosla, Co-Founder & CEO, OakNorth in conversation with Tunde Olanrewaju, Senior Partner, McKinsey & Company.

We would like to offer our thanks to both Rishi and Tunde for generously giving their time, alongside the 150+ attendees to the session for their contributions to the session, co-hosted with 2020 Knowledge Partner, McKinsey & Company.

The following lessons for founders and CEOs emerged from the discussion, focusing on managing businesses through crises and adapting to survive:

—–

1. Focus must be totally streamlined in crisis periods

- Scrap all non-essential projects: your focus should be on the core, even if you can afford peripheral activity.

- M&A should be pondered wisely: acquiring a business is a major distraction and if tangential to where you currently are then it can dilute your focus, however, acquiring adjacencies and strategic diversification could still be fruitful.

- Clarify the objectives for your customer base: if your business is unable to open until the end of the year, what product or service can you provide until then?

2. Strong, clear leadership is vital

- Through periods of increased intensity, founders and C-Suite leaders should deliver unifying calls to their teams.

- Motivation and productivity are vital, and working on these has never been more important than with dispersed organisations.

- Reallocate team resources to assessing your changing market so you can seize any upside opportunities as they emerge.

3. Liquidity is key to thrive and survive

- If you know you can only survive for three months, cut everything non-essential to elongate your runway.

- Be open to discussing financial arrangements with your executive team, i.e. taking cuts on salary whilst the business is struggling to make a profit – if the mission is clear, they will understand.

- If necessary to raise external funding, remember that down rounds are a viable option: there is a massive stigma around down rounds in private markets, yet these are acceptable in public markets and could keep your business afloat

4. Credibility is built in times of uncertainty

- The strongest businesses are built in adverse conditions and markets understand this. As such, perseverance is vital; if you knock on as many doors as you can, eventually someone will believe you and will be willing to support you financially.

- Showing proof of momentum is incredibly helpful in building credibility: if you can prove your proposition still holds in difficult times, you will develop an edge that will be reflected in your future performance.

—

FF Live is the home of Founders Forum’s online event series, including fireside chats, brainstorm sessions, Q&As, panels and founder-focused advice. Run independently and as collaborations with our partners, FF Live seeks to recreate the magic of Founders Forum, wherever we are in the world. To keep up with the FF Live series, subscribe to Founders News for weekly updates and the latest tech news delivered to your inbox.

All Posts

All Posts