Last updated on January 20, 2025

An abridged version of this article was published in The Times on 08/02/2021.

My generation of entrepreneurs cut its teeth in the dotcom era on the building and selling of billion-pound companies. It was an exciting time, but there’s something more compelling than the building of a unicorn itself.

After selling Lastminute.com, I turned to Reid Hoffman, the founder of LinkedIn, for advice on what to do next. We discussed philanthropy (amongst other things) and, more specifically, how as a founder you can leverage not only your money, but your time, advice and network to support the next wave of entrepreneurs. This has been my motivator ever since.

Nothing beats the thrill of spotting brilliant people and wanting to catalyse their success: Matthew Hodgson of next-gen messaging platform Element, Rand Hindi of Zama.ai, Miroslava Duma of Pangaia and Jean Charles Samuelian of Alan.eu are the latest quad to provoke said excitement. It’s one feeling being in the throng of a rapidly growing start-up; it’s another to give founders the tools to do this for themselves – particularly when it’s companies doing good for the world.

Thankfully this sentiment is widespread: there is near-universal recognition that entrepreneurship will underwrite the future of both our planet and its inhabitants.

For evidence of this on a local level, take the UK Government’s Future Fund: nearly £1bn has been pledged since May last year to propel leading British-born companies through the pandemic. But national governments are not the only source of lifeblood for entrepreneurship. We are witnessing a proliferation of local technology heroes picking up the social baton and reinvesting in their countries’ futures.

The legendary ‘PayPal Mafia’ – a group of former PayPal employees and founders, including Hoffman and Elon Musk, who have since founded other household technology names – have long paved the way for this type of serial founder-investor behaviour in the United States, repeatedly using the proceeds of their own success to invest in their nation’s tech ecosystems. This path is less trodden in Europe.

That’s not to say that European tech founders are not interested in investing: they are beginning to signal their ambition for global leadership in this self-sustaining undertaking.

With a combined paper wealth of £8.5bn (up from £4.5bn in 2019), Britain’s top 100 entrepreneurs alone have a lot to invest. That’s before you’ve even totted up the European total, or indeed quantified their non-calculable value.

I’ve witnessed this momentum first-hand, having spent some of lockdown raising the second seed fund for firstminute capital, the investment firm I co-founded.

We have an unprecedented 80 unicorn founders on board as investors, all opting to back the next generation. While their financial input is fundamental, their experience is the true differentiator: investing in the new cohort is just as much about inspiring success and imparting experience, strategy, network and credibility as it is parting with cash.

Local tech heroes

So why the new trend of global tech heroes returning to nurture their own, local roots? Take Daniel Ek, founder of Spotify, with his €1bn commitment to explore European moonshots in Energy, HealthTech, BioTech and Material Science. Take José Neves, founder of fashion unicorn Farfetch, pledging ‘two-thirds of everything I have during my life for the sake of Portugal and the Portuguese’, or Daniel Dines, co-founder of UiPath, donating millions to provide access to education for children across Romania.

Many have anecdotally attributed this urge to the sense of gratitude they feel for their own breakthrough; the stereotype of a technical genius able to build an empire from their bedroom in a pocket of Eastern Europe is not unfounded. And the stories are inspirational precisely because we perceive their success to be more meritocratic: talented geeks are able to break through regardless of background.

Whatever the motivation, we’re moving towards a model which includes the scope for more influence and engagement in life beyond the individual and their billion-dollar business. What’s important now is that we establish better routes with less friction for founders and operators to reinvest.

Removing friction for founders to reinvest.

There are currently significant gaps in this process: from entrepreneurial education and matching founders with mentors to diverse deployment of funds and tax relief. The emotional impetus to reinvest is there, but the rational incentives and assistance need work.

For a start, we need to incentivise founders to invest more, and to invest better. This is beginning to happen: US-based Spearhead recently launched a fourth fund to teach leading founders the art of seed investing. Similarly, US-based Chamath Palihapitiya provides diverse learners with the money, training and community needed to set out as an emerging investor. The UK’s Creator Fund, backed by Schmidt Futures and Founders Factory, targets an even earlier stage, equipping students with the cash and know-how to run a venture capital fund.

We should give more support to help entrepreneurs export and grow across Europe. This will be particularly pertinent post-Brexit.

Our government could provide more trade, legal and fulfilment support, and our serial founders should share the tales of blood sweat and tears that led to international success. To make mentoring platforms like this accessible to founders of all backgrounds they need to be scaled across the UK and Europe.

Upskilling our nations

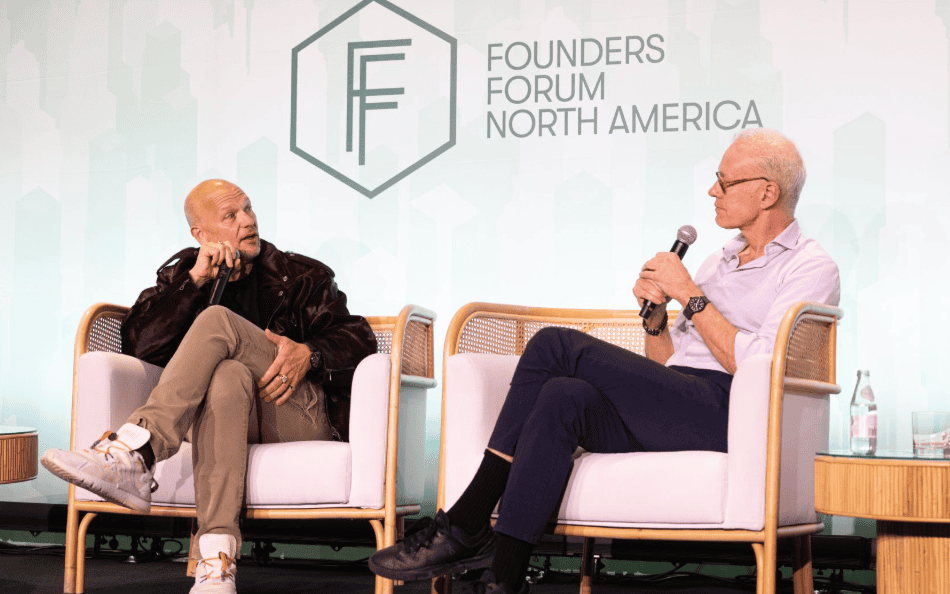

We also need to address the technical skills urgently needed all around the world. Ilkka Paananen, founder of gaming unicorn Supercell, Taavet Hinrikus, co-founder of fintech unicorn TransferWise, and Corinne Vigreux, co-founder of navigation unicorn TomTom have taken on the task of upskilling Finland, Estonia and The Netherlands with the launch of free, teacherless coding schools Hive, Johvi Coding School and Codam. Founders Forum, the entrepreneurial ecosystem I co-founded, is bringing this concept to the UK alongside 01 Edu.

We can encourage founders further through policies like the French one which allows entrepreneurs to reinvest 60 per cent of the capital gains from the sale of their shares in new startups and defer the payment of tax on capital gains.

Similarly, we should continue to encourage investors to allow founders to sell secondary shares to diversify their wealth and reduce risk exposure. The positives are two-fold: less cautious founders, and founders investing in other entrepreneurs before their big exit. This will be important if we are to champion intra-European investing, which, again, is crucial in the post-Brexit landscape.

Lastly, we lack a slick platform that pairs founders with well-matched and willing angels and industry-specific grants. Too much of the fundraising effort is wasted on untargeted and untimely pitches. As a serial founder, I would invest more frequently were the decks that landed in my inbox better suited to what I know and/or can add value to.

The technology industry is proving capable of providing us with a steady flow of cash and experience-rich founders who are eager to have an impact in an ancillary capacity to their governments. We now need to channel our efforts into ensuring that we have the incentives and infrastructure in place to capitalise on this growing resource. From there we can convert it into more robust and diverse pan-European businesses over the course of the next decade.

Written by Brent Hoberman CBE, Co-Founder and Executive Chairman, Founders Forum, Founders Factory, firstminute capital.

An abridged version of this article was published in The Times on 08/02/2021.

All Posts

All Posts