Last updated on January 20, 2025

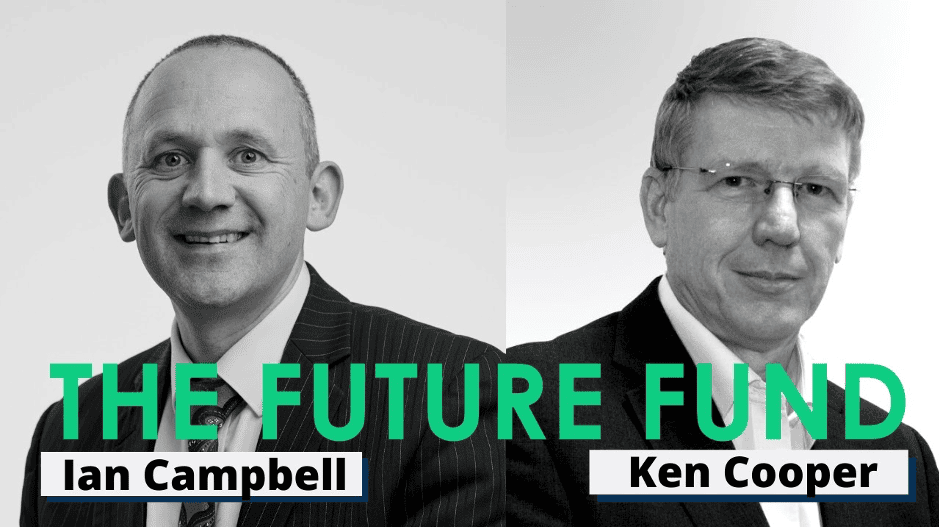

On April 30th, Founders Forum hosted its second online event as part of the FF Live series entitled “The UK’s Future Fund: What It Means For UK Startups”, featuring Dr Ian Campbell, Interim Executive Chair, Innovate UK and Ken Cooper, Managing Director, Venture Solutions, British Business Bank, moderated by Brent Hoberman, Executive Chair, Founders Forum, Founders Factory and firstminute capital.

We would like to offer our thanks to both Ian and Ken for generously giving their time, alongside the 500+ start-up founders and attendees to the session for their contributions.

We acknowledge that many questions still remain about the mechanics and implementation of the Future Fund, but equally recognise the important stance the UK Government has taken to offer this package to startups. You can find the complete recording from the session below.

The following five themes arose from the discussion

1. EIS funding remains ineligible for co-investment with the Future Fund

While previous EIS funding will count towards the £250k minimum funding requirement over the past 5 years, it remains unlikely that EIS funding will be eligible for matching with the Future Fund.

2. The cut-off date for funding eligibility is likely to be April 20th, 2020

This is yet to be clarified, but the cut-off date for funding eligibility is likely to be the date that the Future Fund was announced, April 20th 2020.

3. The intention is for funds with the British Business Bank as an LP to be eligible for the Future Fund

While this has not been set in stone, the intention is that funds with the BBB as an LP, such as the Northern Powerhouse Fund, will be eligible as third-party co-investors for the Future Fund

4. In an oversubscription scenario, the exact selection mechanics remain unclear

The intention behind the Future Fund is to create a diverse and balanced portfolio, but the criteria for selecting companies should the fund become oversubscribed has yet to be decided.

5. The Innovate UK £750M fund will be split across various areas and stages of business

The £750M put aside by Innovate UK to fund UK-based companies has been split into three parts:

- £200M will go to companies already engaged with existing Innovate UK R&D programmes

- £150M will be spent on innovation loans, which any UK-based company across any sector working on an innovative product or service can apply for

- £400M will be spent on grants, with half of this going to new entrants (roughly 1,200 new companies are expected to be funded by these grants)

Companies ineligible for Future Fund assistance can apply for innovation loans. More information will be released in the coming weeks via GOV.UK.

—

FF Live is the home of Founders Forum’s online event series, including fireside chats, brainstorm sessions, Q&As, panels and founder-focused advice. Run independently and as collaborations with our partners, FF Live seeks to recreate the magic of Founders Forum, wherever we are in the world. To keep up with the FF Live series, subscribe to Founders News for weekly updates and the latest tech news delivered to your inbox.

All Posts

All Posts