Last updated on May 13, 2025

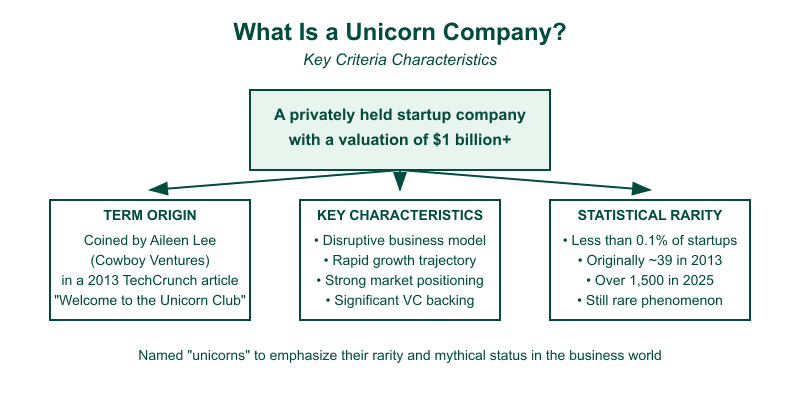

In the fast-paced world of startups and venture capital, “unicorns” represent the rare and magical breed of privately held companies that achieve a valuation of $1 billion or more. The term was first coined by venture capitalist Aileen Lee in a 2013 TechCrunch article, “Welcome to the Unicorn Club,” where she highlighted the statistical rarity of such companies – at that time, just 39 unicorns existed globally.

Since then, the landscape has evolved dramatically. As of April 2025, there are over 1,200+ unicorn companies worldwide collectively valued at more than $4.3 trillion (Source: CBInsights). This remarkable growth demonstrates the tremendous explosion in technology innovation, the maturation of digital business models, and the substantial increase in venture capital availability over the past decade.

Origin of the Term

When Aileen Lee introduced the unicorn concept, these billion-dollar startups were indeed as rare as their mythological namesakes. Lee, founder of Cowboy Ventures, chose the term to emphasise how statistically unusual it was for startups to reach such lofty valuations while still privately held. According to her original analysis, just 0.07% of venture-backed software startups founded in the 2000s reached the $1 billion threshold – meaning roughly one in every 1,538 startups would achieve unicorn status.

Why Unicorns Matter to VCs, Media, and Tech Watchers

Unicorns have become the benchmark for extraordinary success in the startup ecosystem. They matter significantly for several reasons:

- For venture capitalists: Unicorns often represent the outsized returns that can make an entire fund successful. With traditional venture funds growing larger, finding and investing early in potential unicorns becomes increasingly crucial to delivering acceptable returns to limited partners.

- For the media: Unicorn companies make compelling stories of innovation, disruption, and entrepreneurial success. They represent the pinnacle of startup achievement and often signal emerging technology trends and market shifts.

- For tech watchers: Tracking unicorns offers insights into which technologies, business models, and markets are gaining traction and receiving significant capital investment.

- For founders and entrepreneurs: Unicorns provide aspirational success stories and blueprints for scaling startups from zero to billions.

- For the broader economy: Unicorns drive job creation, technological innovation, and economic growth, often becoming the industry leaders of tomorrow.

As we journey through this comprehensive guide to unicorn companies in 2025, we’ll explore the latest statistics, analyse key trends across regions and sectors, and uncover the insights that make these rare companies worth watching.

What Is a Unicorn Company?

Definition and Criteria

A unicorn company is defined as a privately held startup that has reached a valuation of $1 billion or more. This valuation typically comes through funding rounds led by venture capitalists or private equity firms, though occasionally it can result from large corporate investments or secondary market transactions.

The term “unicorn” was specifically chosen to highlight how statistically rare these companies were when the concept was first introduced. Just as unicorns are mythical creatures that don’t exist in the real world, billion-dollar startups were once considered almost mythically rare in the business world.

Key Characteristics of Unicorn Companies

What separates unicorns from other startups? Beyond their valuation, unicorn companies typically share several common characteristics:

- Innovative Business Models: Most unicorns disrupt existing industries through technological innovation or novel business approaches.

- Hypergrowth Trajectory: Unicorns typically demonstrate exceptional growth rates, often doubling or tripling revenue year-over-year during their scaling phase.

- Strong Market Positioning: They typically address large total addressable markets (TAMs) and establish competitive moats through network effects, technological advantages, or brand strength.

- Significant Venture Capital Backing: Most unicorns have raised substantial amounts of venture capital across multiple funding rounds.

- Private Company Status: By definition, unicorns remain privately held when they reach the billion-dollar valuation milestone, distinguishing them from public companies with similar valuations.

Evolution of the Concept

When Aileen Lee first identified the “unicorn club” in 2013, it contained just 39 companies—true to the mythical rarity implied by the name. However, as venture capital has become more abundant and technology companies have scaled more rapidly, the unicorn has become a more common species in the startup ecosystem.

Despite this increased frequency, achieving unicorn status remains an extraordinary accomplishment. Even today, less than 0.1% of startups reach this milestone, making it a noteworthy achievement that continues to capture the attention of investors, media, and aspiring entrepreneurs worldwide.

Unicorn Growth Statistics (2025)

How Many Unicorns Are There?

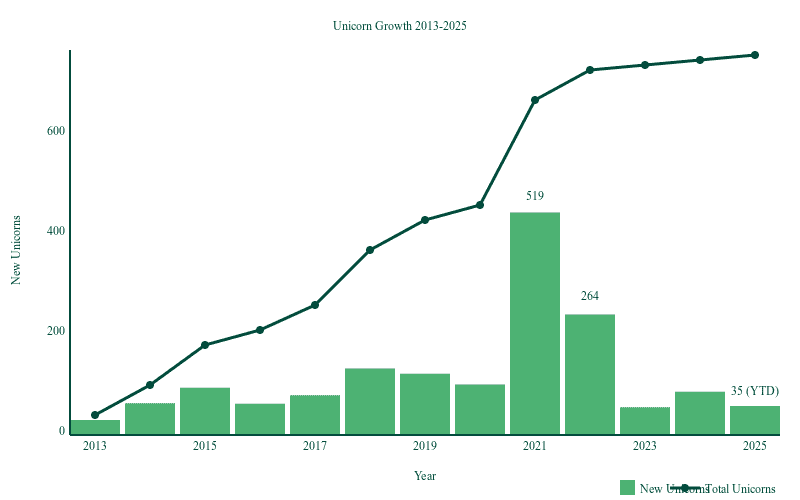

The unicorn landscape has experienced remarkable growth since Aileen Lee’s original 2013 analysis, As of April 2025, there are now over 1,200 unicorn companies globally, representing approximately 26 times growth in just over a decade. (Source: Beauhurst)

This explosive increase is due to several factors:

- Increased venture capital availability: Global VC funding has grown substantially, with more capital available to private companies before they go public.

- Extended private market runways: Companies are staying private longer, allowing them to reach higher valuations before IPOs.

- Technological acceleration: The pace of innovation and technology adoption has increased dramatically.

- Globalisation of the startup ecosystem: While Silicon Valley remains a key hub, unicorns now emerge from ecosystems around the world.

- Lower barriers to scaling: Cloud computing, digital distribution, and other technologies have reduced the capital required to scale globally.

Valuation Trends

The total valuation of all unicorn companies has grown substantially, from approximately $300 billion in 2013 to over $5.9 trillion in 2025. This represents nearly 20x growth in aggregate value.

Several “super-unicorns” (companies valued at over $100 billion while private) have emerged, including:

- SpaceX – $350 billion

- ByteDance – $315 billion

- OpenAI – $300 billion

- xAI – $113 billion

- Stripe – $91.5 billion

These five companies alone account for nearly $1.2 trillion in value, or approximately 20% of the total unicorn valuation pool.

The median unicorn valuation stands at approximately $1.7 billion, with the vast majority falling between $1-3 billion in value. This demonstrates that while the overall unicorn club has expanded dramatically, truly massive valuations remain exceptional cases. (Source: Beauhurst).

Unicorns by Region & Country

Leading Countries

While unicorns now come from over 50 countries, the distribution remains highly concentrated, with the following countries leading the pack:

- United States: 702 unicorns, valued at $3.2 trillion

- China: 302 unicorns, valued at $1.4 trillion

- India: 119 unicorns, valued at $0.4 trillion

- United Kingdom: 104 unicorns, valued at $0.3 trillion

- France: 34 unicorns, valued at $0.1 trillion

(Source: Wikipedia)

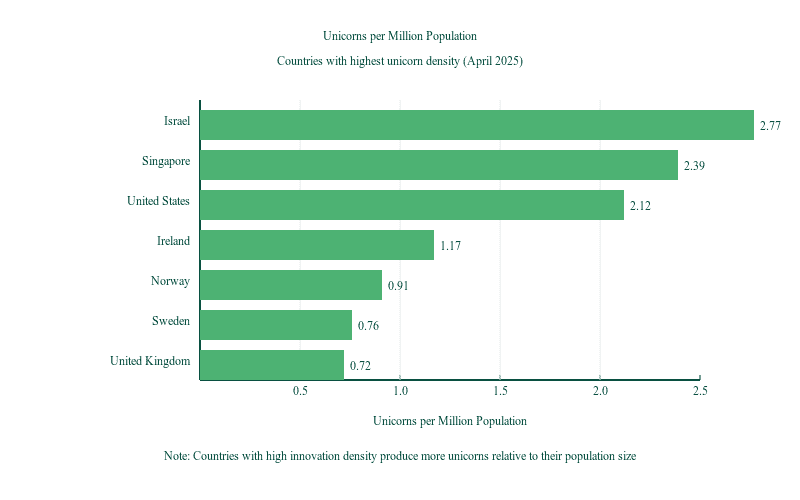

These five countries collectively host 84% of all unicorns globally. However, when adjusting for population, a different picture emerges:

| Country | Unicorns per Million People |

|---|---|

| Israel | 2.77 |

| United States | 2.12 |

| Singapore | 2.39 |

| United Kingdom | 0.72 |

| Sweden | 0.76 |

This density metric reveals that Israel, Singapore, and the United States have created the most fertile ecosystems for producing unicorns relative to their population size.

European Unicorns

Europe has emerged as a significant unicorn hub, with the UK leading the pack. The distribution within Europe shows:

Table of the number of unicorn startups by country as of April 13, 2025:

| Country | Number of Unicorns |

|---|---|

| United Kingdom | 104 |

| France | 34 |

| Germany | 29 |

| Sweden | 8 |

| Netherlands | 7 |

| Switzerland | 6 |

| Ireland | 6 |

European unicorns tend to be concentrated in specific sectors, particularly fintech, enterprise software, and e-commerce. The regional tech hubs of London, Paris, Berlin, and Stockholm are responsible for producing the majority of Europe’s unicorns.

(Source: Wikipedia)

US Unicorns

Within the United States, unicorn formation remains highly concentrated in a few key states:

- California: 384 unicorns (55% of US total), primarily in the San Francisco Bay Area

- New York: 127 unicorns (18% of US total)

- Massachusetts: 45 unicorns (6% of US total)

- Texas: 37 unicorns (5% of US total)

- Florida: 20 unicorns (3% of US total)

The remaining 89 unicorns (13%) are distributed across 21 other states.

Asian Unicorns

Asia’s unicorn landscape is dominated by China and India, which together account for 90% of the region’s total. Notable trends include:

- China: Strength in consumer tech, AI, and e-commerce

- India: Focus on fintech, e-commerce, and services

- Singapore: Emerging as Southeast Asia’s unicorn hub

- South Korea: Strong in gaming, entertainment, and consumer tech

- Japan: Focused on robotics, AI, and enterprise software

Largest Unicorns in the World

Top 20 Most Valuable Unicorns

As of April 2025, the world’s most valuable unicorns represent a diverse range of sectors and geographies:

| Rank | Company | Valuation (USD) | Country | Sector | Founded |

|---|---|---|---|---|---|

| 1 | SpaceX | $350B | United States | Aerospace | 2002 |

| 2 | ByteDance | $315B | China | Media & Entertainment | 2012 |

| 3 | OpenAI | $300B | United States | AI | 2015 |

| 4 | xAI | $113B | United States | AI | 2023 |

| 5 | Stripe | $91.5B | United States/Ireland | Fintech | 2010 |

| 6 | Shein | $66B | China | E-commerce | 2008 |

| 7 | Databricks | $62B | United States | Enterprise Software | 2013 |

| 8 | Anthropic | $61.5B | United States | AI | 2021 |

| 9 | Safe Superintelligence | $32B | United States/Israel | AI | 2024 |

| 10 | Epic Games | $31.5B | United States | Gaming | 1991 |

| 11 | Telegram | $30B | UAE | Messaging | 2013 |

| 12 | Canva | $32B | Australia | Design Software | 2012 |

| 13 | Anduril Industries | $28B | United States | Defense Tech | 2017 |

| 14 | Fanatics | $27B | United States | E-commerce | 2011 |

| 15 | Chime | $25B | United States | Fintech | 2013 |

| 16 | Perplexity AI | $18B | United States | AI | 2022 |

| 17 | Revolut | $17.75B | United Kingdom | Fintech | 2015 |

| 18 | Miro | $17.5B | United States | Collaboration Software | 2011 |

| 19 | Nature’s Fynd | $17B | United States | Food Tech | 2012 |

(Source: Wikipedia)

Key Trends Among Top Unicorns

Several patterns emerge when examining the world’s most valuable unicorns:

- AI dominance: Four of the top nine companies are focused on artificial intelligence, reflecting the extraordinary capital flowing into this sector since 2022.

- American leadership: 13 of the top 20 unicorns are based in the United States, highlighting its continued dominance in creating high-value startups.

- Sector diversity: The top 20 represent various sectors, including aerospace, social media, fintech, e-commerce, and enterprise software.

- Founding dates: Most top unicorns were founded between 2010-2015, indicating that building a super-valuable company typically takes 10+ years, with AI companies being notable exceptions.

- Capital efficiency: Some top unicorns, like Canva and Telegram, reached massive valuations while raising relatively modest amounts of venture capital.

Recent Valuation Changes

The valuations of top unicorns have experienced significant fluctuations over the past year:

- Upward movers: AI companies like Anthropic, OpenAI, and xAI have seen dramatic valuation increases, with OpenAI’s valuation growing from $86 billion to $300 billion.

- Downward adjustments: Several e-commerce and fintech unicorns have experienced valuation reductions in private markets, reflecting the broader tech market correction.

- Stable foundations: Infrastructure-focused companies like Stripe and Databricks have maintained more stable valuations despite market turbulence.

Funding Behind Unicorn Status

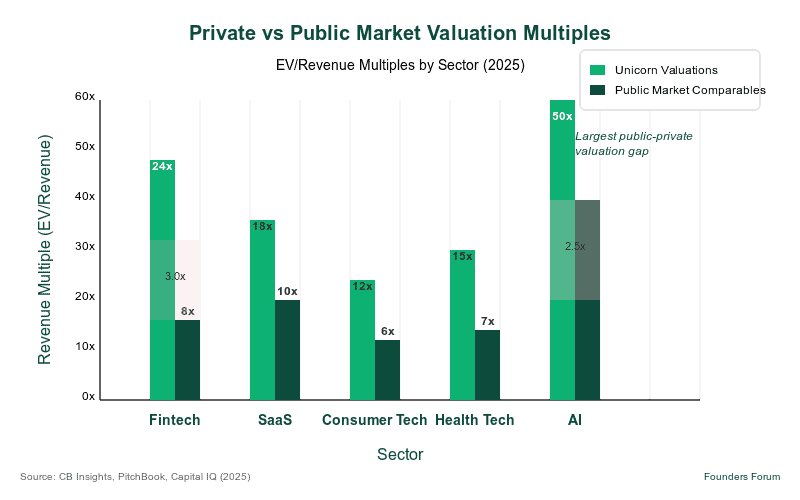

Unicorn Valuation Formula

While there’s no exact formula for unicorn valuation, most follow similar patterns:

- Multiple-based valuation: Typically based on revenue multiples (10-100x revenue) or growth-adjusted multiples

- Comparable company analysis: Benchmarking against similar public and private companies

- Future growth projections: Factoring expected growth rates and market opportunities

- Strategic value: Premium for companies dominating emerging categories or technologies

- Market conditions: Influenced by capital availability and investor sentiment

The median unicorn in 2025 has raised approximately $275 million across 5 funding rounds before achieving its billion-dollar status.

Capital Raised by Stage

The typical funding journey for unicorns shows a clear pattern:

| Funding Stage | Median Amount (2025) | Range | Typical Timing |

|---|---|---|---|

| Pre-seed/Angel | $1.5M | $0.25-3M | Year 0-1 |

| Seed | $8M | $2-20M | Year 1-2 |

| Series A | $25M | $10-50M | Year 2-3 |

| Series B | $60M | $30-100M | Year 3-4 |

| Series C | $120M | $50-300M | Year 4-6 |

| Series D+ | $200M+ | $100M-1B+ | Year 6+ |

These figures have increased substantially over the past decade, with each funding stage now approximately 2-3 times larger than in 2013.

Top VCs in Unicorn Creation

Certain venture capital firms have demonstrated particular skill at identifying and nurturing future unicorns:

| Rank | Firm | Unicorn Investments | Notable Investments |

|---|---|---|---|

| 1 | Sequoia Capital | 234 | ByteDance, Stripe, Klarna |

| 2 | Tiger Global | 207 | Bytedance, SHEIN, Checkout.com |

| 3 | SoftBank Vision Fund | 178 | ByteDance, Klarna, Fanatics |

| 4 | Andreessen Horowitz | 171 | OpenAI, Databricks, Stripe |

| 5 | Accel | 121 | Slack, Canva, UiPath |

| 6 | Insight Partners | 118 | Twitter, Shopify, Monday.com |

| 7 | GGV Capital | 95 | Airbnb, Slack, ByteDance |

| 8 | Index Ventures | 89 | Revolut, Robinhood, Canva |

| 9 | Lightspeed Venture Partners | 85 | Snapchat, Affirm, Epic Games |

| 10 | Coatue Management | 83 | Databricks, DoorDash, Chime |

How Unicorns Are Funded

The path to unicorn status has evolved over time, with several distinct funding strategies emerging:

- Traditional VC path: Multiple funding rounds from seed through Series C/D/E, gradually increasing valuations (70% of unicorns)

- Crossover strategy: Early VC funding followed by late-stage investments from mutual funds, sovereign wealth funds, and private equity (20% of unicorns)

- Bootstrap to unicorn: Minimal outside funding until a large, unicorn-making round (5% of unicorns)

- Corporate accelerated: Strategic corporate investment playing a significant role in growth funding (5% of unicorns)

Geographic differences are notable as well:

- US unicorns: Typically raise the most capital, with a median of $320M before reaching unicorn status

- European unicorns: Often more capital efficient, with a median of $180M raised

- Asian unicorns: Show the greatest variance, ranging from highly capital-intensive ($500M+) to relatively efficient ($100M)

Sectors Dominated by Unicorns

Sector Split by Count and Value

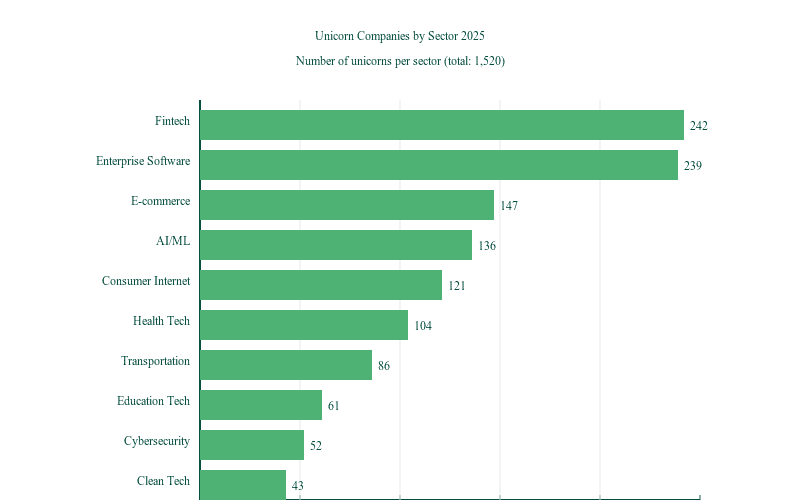

The unicorn landscape spans numerous sectors, with some showing particularly high concentrations:

| Sector | Number of Unicorns | Percentage | Total Valuation | Avg. Valuation |

|---|---|---|---|---|

| Fintech | 242 | 16.0% | $950B | $3.9B |

| Enterprise Software | 239 | 15.7% | $880B | $3.7B |

| E-commerce | 147 | 9.7% | $595B | $4.0B |

| AI/ML | 136 | 9.0% | $955B | $7.0B |

| Consumer Internet | 121 | 8.0% | $580B | $4.8B |

| Health Tech | 104 | 6.8% | $390B | $3.8B |

| Transportation | 86 | 5.7% | $265B | $3.1B |

| Education Tech | 61 | 4.0% | $195B | $3.2B |

| Cybersecurity | 52 | 3.4% | $185B | $3.6B |

| Clean Tech | 43 | 2.8% | $150B | $3.5B |

| Other | 289 | 18.9% | $835B | $2.9B |

(Source: CBInsights)

Fintech Unicorns

With 242 companies, fintech remains the largest unicorn sector by company count. Key sub-segments include:

- Payments: 68 unicorns (including Stripe, Checkout.com)

- Banking: 51 unicorns (including Chime, Revolut)

- Lending: 43 unicorns

- Wealth & Investment: 32 unicorns

- Insurance: 28 unicorns

- Crypto/Blockchain: 20 unicorns

Fintech unicorns have flourished by addressing inefficiencies in traditional financial services through better user experiences, lower costs, and innovative business models.

AI Unicorns

While AI companies represent only 9% of total unicorns by count, they account for 16% of total valuation due to the extraordinary valuations of companies like OpenAI, Anthropic, and xAI.

The AI unicorn landscape includes:

- Foundation Models: 14 unicorns (companies building large language models and general-purpose AI systems)

- Enterprise AI Tools: 47 unicorns (AI for specific business functions)

- Industry-Specific AI: 38 unicorns (AI focused on healthcare, finance, etc.)

- AI Infrastructure: 37 unicorns (companies building the computational foundation for AI)

AI unicorns have seen the fastest valuation growth, with the average time from founding to unicorn status just 3.4 years compared to the overall average of 7.2 years.

Enterprise Software Unicorns

Enterprise software remains a unicorn powerhouse with 239 companies. Key categories include:

- SaaS Platforms: 89 unicorns

- Developer Tools: 51 unicorns

- Data & Analytics: 47 unicorns

- Collaboration Software: 31 unicorns

- Enterprise Infrastructure: 21 unicorns

These companies typically demonstrate strong recurring revenue models, high gross margins, and capital efficiency, making them attractive to investors even in more cautious market conditions.

Emerging Unicorn Sectors

Several sectors are showing accelerating unicorn formation:

- Climate Tech: 43 unicorns, up from just 12 in 2021

- Space Technology: 15 unicorns, up from 5 in 2021

- Synthetic Biology: 28 unicorns, up from 9 in 2021

- Manufacturing Technology: 32 unicorns, up from 14 in 2021

Time to Unicorn: How Long Does It Take?

Average Years to Unicorn Status

The time it takes for startups to reach unicorn status has evolved over the years:

| Time Period | Average Years to Unicorn | Median Years to Unicorn |

|---|---|---|

| Pre-2015 | 8.5 years | 7.9 years |

| 2015-2019 | 7.3 years | 6.8 years |

| 2020-2021 | 6.2 years | 5.1 years |

| 2022-2025 | 7.8 years | 7.2 years |

| All-time | 7.2 years | 6.7 years |

Several factors influence this timeline:

- The 2020-2021 period saw significantly accelerated paths to unicorn status due to abundant capital and high valuations

- Since 2022, more cautious investor sentiment has extended the timeline again

- Company age at first funding has decreased over time, with more founders raising capital at the idea stage

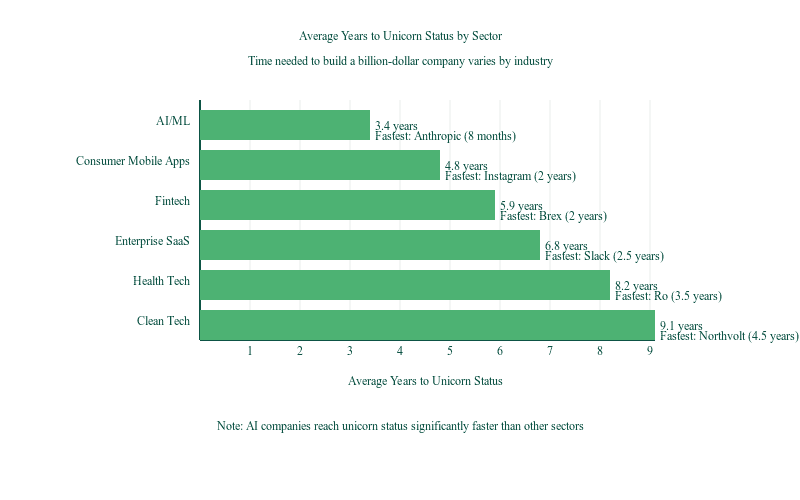

Fastest Unicorns by Sector

Some sectors produce unicorns more quickly than others:

| Sector | Average Years to Unicorn | Fastest Example |

|---|---|---|

| AI/ML | 3.4 years | Anthropic (8 months) |

| Consumer Mobile Apps | 4.8 years | Instagram (2 years) |

| Fintech | 5.9 years | Brex (2 years) |

| Enterprise SaaS | 6.8 years | Slack (2.5 years) |

| Health Tech | 8.2 years | Ro (3.5 years) |

| Clean Tech | 9.1 years | Northvolt (4.5 years) |

Factors That Accelerate Unicorn Timeline

Several factors correlate with faster paths to unicorn status:

- Founder experience: Serial entrepreneurs reach unicorn status 2.1 years faster on average

- Top-tier VC backing: Companies backed by top 10 VCs reach unicorn status 1.7 years faster

- Network effects: Business models with strong network effects reach unicorn status 1.9 years faster

- Capital intensity: Lower capital requirements correlate with faster unicorn creation

- Market timing: Companies riding emerging technology waves (cloud, mobile, AI) reach unicorn status significantly faster

Future Trends: Next 50 Predicted Unicorns

Soonicorns: On the Path to $1 Billion

The next wave of potential unicorns (often called “soonicorns”) provides insight into emerging trends and technologies. Key companies to watch include:

| Company | Current Valuation | Sector | Country | Key Investors |

|---|---|---|---|---|

| Stability AI | $945M | AI/ML | United Kingdom | Coatue, Lightspeed |

| Replit | $950M | Developer Tools | United States | a16z, Craft Ventures |

| Inigo | $745M | Insurtech | United Kingdom | CDPQ, Oak HC/FT |

| Neko Health | $850M | Health Tech | Sweden | General Catalyst |

| Cursor | $950M | AI Tools | United States | a16z, Thrive Capital |

| Lunchbox | $820M | Restaurant Tech | United States | Coatue, Primary Venture |

| Ansa | $900M | Finance | Mexico | General Catalyst |

| CarbonClean | $541M | Climate Tech | United Kingdom | Chevron Technology |

| Planetary AI | $780M | Climate Tech | United States | Khosla Ventures |

| Move | $830M | Real Estate | United States | Fifth Wall, NFX |

(Source: Beauhurst)

Emerging Technology Trends

Several technology trends are driving the next wave of unicorn creation:

- Generative AI infrastructure: Tools and platforms that make AI accessible for various business applications

- AI-native applications: Applications built from the ground up to leverage foundation models

- Climate technology: Solutions addressing decarbonisation, energy efficiency, and climate adaptation

- Sovereign AI: Country and region-specific AI models to address regulatory and language requirements

- Spatial computing: AR/VR applications advancing beyond gaming into enterprise use cases

- Synthetic biology: Programming biology for applications in materials, medicine, and agriculture

- Financial infrastructure: Next-generation payment, compliance, and banking systems

Geographic Expansion

The next wave of unicorns is likely to feature greater geographic diversity:

- Emerging unicorn hubs: Cities like Stockholm, Singapore, Seoul, Mexico City, Sao Paulo, and Dubai are producing more potential unicorns

- Regional specialisation: Different regions are developing expertise in specific sectors (e.g., Europe in fintech, LATAM in logistics)

- Cross-border founders: Increasing number of startups with distributed founding teams across multiple countries

Key Infographics & Data Visualisations

Below you’ll find a collection of data visualisations that illuminate the key trends and insights from our unicorn company research:

Unicorn Growth 2013-2025

Global Distribution of Unicorns 2025

Unicorn Companies by Sector 2025

Unicorns per Million Population

Average Years to Unicorn Status by Sector

Private vs Public Market Valuation Multiples

Conclusion

The unicorn phenomenon has evolved dramatically since Aileen Lee first coined the term in 2013. What was once a statistical rarity has become a more attainable aspiration for ambitious founders and investors, though still representing the elite 0.1% of all startups.

Several key conclusions can be drawn from our analysis:

- Market cycles matter: Unicorn creation is highly sensitive to capital market conditions, with significant acceleration during abundant capital periods (2018-2021) and contraction during tighter conditions (2022-2023).

- Geographic diversification continues: While the US and China still dominate, unicorns are emerging from an increasingly diverse set of countries and regions.

- AI has changed the game: The extraordinary valuations and accelerated timelines of AI unicorns have reshaped expectations in the startup ecosystem.

- Sector rotation is real: Different sectors lead unicorn creation in different eras, reflecting broader technology and market trends.

- The bar is rising: With greater scrutiny on unit economics and business fundamentals, the requirements for reaching unicorn status have become more stringent since 2022.

- Founder experience matters: Serial entrepreneurs and founding teams with prior startup experience continue to have advantages in building unicorns.

As we look ahead, the unicorn landscape will undoubtedly continue to evolve. While the days of unprecedented unicorn creation in 2021 may not return soon, the global innovation ecosystem remains robust. Truly transformative companies with strong business models and genuine competitive advantages will continue to achieve unicorn status, providing investors with opportunities for outsized returns and reshaping industries across the global economy.

This report was produced by Founders Forum, leveraging data from

CB Insights – http://www.cbinsights.com/research-unicorn-companies

Crunchbase – https://news.crunchbase.com/unicorn-company-list

Beauhurst – https://www.beauhurst.com/research/unicorn-companies

Wikipedia – https://en.wikipedia.org/wiki/List_of_unicorn_startup_companies

TechCrunch – https://techcrunch.com/2013/11/02/welcome-to-the-unicorn-club

Last updated: April 2025.

All Posts

All Posts