Last updated on September 17, 2025

AI acquihires are on the rise! Discover why Big Tech is spending billions on talent, not products – and what it means for AI startups.

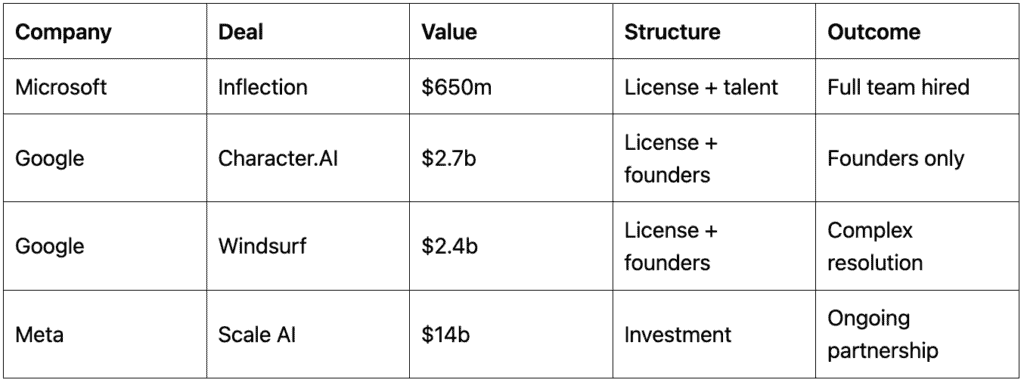

When Google paid $2.4b for AI startup Windsurf, they weren’t buying its code editor; they were buying its founders. When Microsoft handed over $650m to Inflection, they weren’t after its chatbot; they wanted Mustafa Suleyman and his AI research team.

This is the new reality of Silicon Valley’s acquire for hire model – and it’s reshaping how startups think about exits.

What Is an Acquihire? The Acquire for Hire Playbook

An acquihire happens when a company acquires another organisation primarily for its talent rather than its products or services. In the AI industry, this acquire for hire approach has become both more sophisticated and more expensive.

Traditional acquisitions transfer everything: products, IP, customers, and staff. But AI acquihires work differently. Companies like Microsoft and Google have pioneered hybrid deals that combine massive licensing payments with selective talent acquisition.

Key differences between acquihires and traditional acquisitions:

- Talent focus: The team is the primary asset, not the product

- Licensing structure: Non-exclusive technology licenses rather than IP ownership

- Speed: Integration happens in weeks, not months

- Regulatory advantages: Could avoid antitrust scrutiny of full mergers

The numbers tell the story. Google’s Character.AI acquihire cost $2.7b. Microsoft’s Inflection deal reached $650m. Meta has invested $14b in Scale AI while systematically poaching its competitors’ talent.

There’s even a trend called the ‘reverse acquihire’, where startups actively position themselves to be acquired purely for their talent. They’re not building products to sell; they’re building teams that Big Tech can’t resist.

Microsoft’s Acquihire Strategy: The Inflection Deal That Changed Everything

Microsoft pioneered the modern AI acquihire playbook with its Inflection deal. The company paid $650m to license Inflection’s technology and hire most of its staff, including co-founder Mustafa Suleyman, who became Microsoft’s EVP and CEO of Microsoft AI.

This Microsoft acquihire set the template for three reasons:

- It avoided antitrust concerns through creative structuring

- It integrated talent rapidly into existing teams

- It kept all stakeholders happy – investors, founders, and employees

Microsoft paid back Inflection’s investors their full $1.3b investment, ensuring everyone walked away satisfied. Employees got job security at Microsoft with their vesting schedules intact. Inflection continued to exist as a company, just without most of its staff.

What made this Microsoft acquihire particularly significant was the talent density. Microsoft acquired Inflection’s entire AI research team – people who’d been building large language models competitive with GPT-4. When top AI researchers command $10m+ packages individually, bulk-hiring an entire proven team made economic sense.

The deal also demonstrated speed. While traditional acquisitions take months of due diligence, Microsoft integrated Suleyman’s team within weeks. In the AI race, that speed matters.

Google and Meta’s Billion-Dollar Talent Grabs

Google has executed some of the largest acquihires in tech history. The Character.AI deal in 2024 saw Google pay $2.7b for what was essentially a non-exclusive license and the company’s founders, Noam Shazeer and Daniel De Freitas. Both were former Google employees who’d helped create the transformer architecture behind modern AI.

The Windsurf acquihire revealed the brutal side of these deals. Google’s $2.4b acquisition focused on the founders and technology license, initially leaving employees with uncertain equity outcomes. Only Cognition’s subsequent acquisition of Windsurf’s remaining assets secured value for the broader team.

Meta takes a different approach to acquiring AI talent:

- Strategic investments: $14b invested in Scale AI without full acquisition

- Individual poaching: Offering $100m+ packages to top researchers

- Team acquisitions: Hiring entire research groups from competitors

- Academic partnerships: Funding university labs to secure talent pipelines

| Company |

These Facebook acquire strategies reflect different philosophies. So far, Google and Microsoft tend to prefer clean acquihires that bring entire teams. Meta maintains arm’s length relationships through investments while cherry-picking individual talent.

Reverse Acquihires and New Models

The reverse acquihire represents Silicon Valley’s newest strategy. Instead of building products for IPO or traditional acquisition, some AI startups now optimise specifically for talent acquisition.

How reverse acquihires work:

- Startups hire aggressively from top AI programmes (Stanford, MIT, DeepMind)

- They publish impressive research papers to build credibility

- They raise modest funding to sustain operations

- They wait for Big Tech to recognise their talent concentration

This acquire for hire model has created what insiders call the HALO effect – Hire And License Out. Companies structure deals to hire key personnel while taking non-exclusive licenses to technology, avoiding both antitrust scrutiny and the complications of full acquisition.

The economics make sense. Training a single state-of-the-art model costs $100m+. The researchers who know how to build these models efficiently are invaluable. Startups that aggregate this talent become acquisition targets regardless of revenue or product-market fit.

Some startups are being fairly explicit about this strategy. They position themselves as ‘talent density plays’ – betting that their team’s collective expertise is worth more than any product they might build.

The Real Cost: Acquihire Payouts and Employee Impact

Not everyone wins equally in an acquihire. The disparity in acquihire payouts has become a major concern in Silicon Valley, with outcomes varying dramatically between founders and employees.

Typical payout structures:

- Founders: Often receive hundreds of millions in cash and stock

- Early employees: May see accelerated vesting or retention bonuses

- Later employees: Sometimes face worthless equity if not included in deals

- Investors: Usually made whole or see modest returns

The Windsurf case exposed these disparities starkly. While founders secured a massive payout through Google’s licensing deal, employees initially faced the prospect of worthless equity. Cognition’s intervention salvaged employee outcomes, but not all acquihires end so fortunately.

Successful acquihire agreements protect all stakeholders. Microsoft’s Inflection deal accelerated vesting for the entire team. But pure licensing deals with founder hires – like some recent Google agreements – can leave employees behind.

Smart employees now ask about acquihire provisions during hiring negotiations. Key questions include:

- What happens to equity in an acquihire scenario?

- Are there acceleration clauses for change of control?

- How are retention bonuses structured?

What This Means for AI Startups

For some, the rise of AI acquihires could fundamentally change startup strategy. Traditional metrics like revenue and user growth matter less than team composition and research output.

New success metrics for AI startups:

- Talent density: PhDs per square foot matters more than ARR

- Publication record: Nature papers trump product launches

- Technical moat: Novel architectures beat market share

- Team pedigree: Ex-DeepMind/OpenAI experience commands premiums

The acquire hire trend will likely accelerate as competition intensifies. With only a few thousand people globally capable of training frontier AI models, the talent war has just begun. Startups that effectively aggregate this talent position themselves for billion-dollar exits, regardless of traditional business metrics.

For founders, the message is clear: in AI, your team is your product. Build exceptional talent density, demonstrate technical capabilities through research, and Big Tech will find a creative way to acquire you – whether through traditional M&A, licensing deals, or structures yet to be invented.

The age of the acquihire isn’t just changing how companies exit; it’s redefining what it means to build a successful startup.

Want to learn more about AI trends and opportunities? Subscribe to Founders News for fortnightly insights from the FF community.

All Posts

All Posts