Last updated on January 21, 2025

Founders Forum recently hosted the 18th session in the FF Live digital series talking all things tech under the theme “Paradigm Shift or Accelerated Trends”, in partnership with McKinsey & Co and the Softbank Vision Fund.

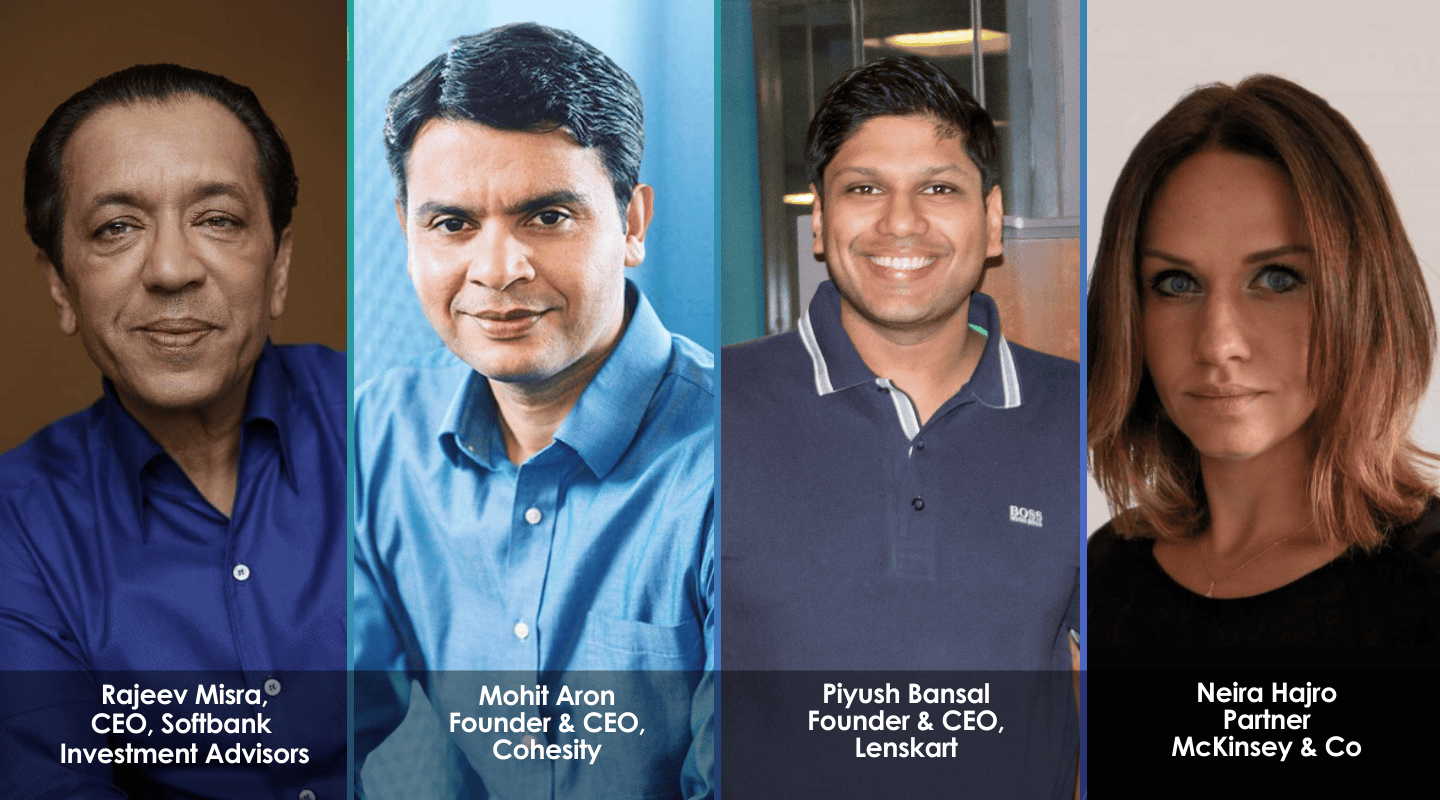

In conversation was Rajeev Misra (CEO, SoftBank Investment Advisers), Peyush Bansal (CEO, Lenskart) & Mohit Aron (Founder & CEO, Cohesity), moderated by Neira Hajro (Partner, McKinsey & Company).

The discussion centred on how the Vision Fund’s investment strategy has been impacted by Covid-19, and what makes a successful founder who can scale their business to a sizable valuation.

We would like to offer our thanks to all involved for generously giving their time, alongside our partners at the Vision Fund and McKinsey&Co, as well as the 230+ attendees to the session for their contributions.

The following insights emerged from the discussion:

—–

1. Covid has accelerated the pace of tech disruption and pushed consumers towards an ever-more digital new normal

- The Vision Fund continues to focus its investments on areas where technology is disrupting human behaviour and broader society

- Covid, first and foremost a global humanitarian challenge, has nonetheless created disruption opportunities notably across three areas: consumer consumption from ‘dark’ sites, online education, and digital healthcare

- ‘Dark’ consumption, including at-home grocery delivery from warehouse-only supermarkets, dark-kitchens (where chefs prepare food without a front of house) providing at-home takeaway meals, and increased last-mile activity from traditional retailers has been aggressively accelerated by the Covid crisis

- Similarly, online education has seen rapid innovation due to the closure of schools and universities, and the global quarantines has proven a large percentage of in-person healthcare services can also be offered effectively through telemedicine.

2. Humility and continuous learning are vital assets for early-stage founders

- Key attributes that demonstrate the potential of an early-stage founder include humility, a desire to constantly be learning, and an ability to surround oneself with smart, adaptable people

- Beyond this, an obsession over the consumer, to the extent that a business is built backwards from the consumer to the product, was also cited as key for founder success

- Panellists counselled founders to focus on building their brand, even if the business is totally B2B or a SaaS play where brand feels unimportant, as with scale, the brand becomes increasingly relevant later on

3. The Vision Fund looks to invest in repeat entrepreneurs who can make key decisions

- When making investments, the Vision Fund likes backing repeat entrepreneurs, such as Cohesity founder Mohit Aron who previously set up and ran Nutanix

- Technically oriented founders are also valued for their deep understanding of product

- Beyond these, Vision Fund investors see the belief that a business can take on established industry giants and fundamentally disrupt a market as key to long-term success

4. SoftBank’s ecosystem provides a myriad of benefits to portfolio companies

- The benefits of SoftBank’s portfolio network manifest in various forms

- There are obvious synergies, such as partnerships between portfolio companies such as Reef’s Dark Kitchens and Doordash’s food delivery

- But also less obvious opportunities such as the ability to scale in new markets, such as Lenskart entering the Middle East, or Cohesity’s expansion into Japan

- The network also acts as a powerful signal, demonstrating that a business is part of a club of disruptors who can create cross-industry connections

- However, these are all secondary to a business standing on its own two feet, and only a small part of a Vision Fund investment decision is based on network effects

“75-80% of a SoftBank investment is the business, and the other 20% is the network effects that business will provide; the gravy on the top” – Rajeev Misra

5. Travel restrictions are limiting foreign investment in a fast-recovering Asia

- Business activity in Asia has made the earliest recovery from from Covid, as the region moves beyond the crisis ahead of Europe, the United States and Africa

- However, investors can find better valuations in nations such as Korea and Taiwan as there are fewer local investors compared to the US and Europe

- Due to travel restrictions it has become very difficult to invest internationally, with due diligence, team meetings and culture check hard to carry out remotely

- This is tied in with an unwinding of globalisation: the increasing belief tech stacks should be owned locally and the politically motivated rejection of foreign capital

—–

Founders Forum is Europe’s pre-eminent entrepreneur network, gathering founders and senior executives alongside government and thought leaders to discuss, debate and collaborate on the impact of technology on industries and society.

FF Live is the home for all Founders Forum’s virtual events, seeking to recreate the magic of Founders Forum wherever we are in the world. For more information on the FF Live series, follow us on LinkedIn and sign up to our newsletter, Founders News.

Founders Forum has also built a family of businesses, supporting entrepreneurs at every stage of their journey, across advisory, executive search, giving, diversity and inclusion, education and more.

All Posts

All Posts