Last updated on November 11, 2025

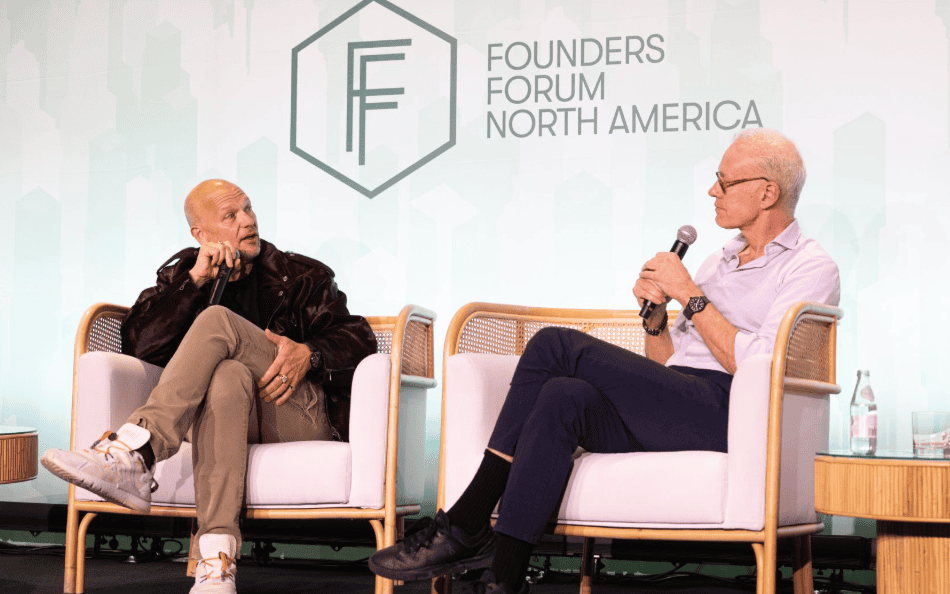

From IPO to acquisition, Deliveroo’s Will Shu reveals how he navigated public-market pressures, founder identity, and a landmark sale to DoorDash in the UK Exit 50.

After twelve years leading Deliveroo, Will Shu has stepped down as CEO. Having led one of the UK’s most talked-about listings taking Deliveroo public in 2021, and steered its $3.9b acquisition by US food-delivery giant, DoorDash, in May this year – his journey reveals what it takes to balance public-market pressure and build a successful exit strategy.

This interview is part of our UK Exit 50, published in partnership with HSBC Innovation Banking, where we showcase the UK’s top 50 exits and IPOs of the past 24 months, and uncover key exit market trends, plus the strategies, timing decisions, and wealth planning considerations that shaped these successful company exits.

How did the acquisition by DoorDash come about?

When we look at the global landscape, there are a few consolidators out there; $100b+ companies like Uber and DoorDash. I know the founders of these companies well; we all started around the same time; we understand each other’s business models. To invest in the business as much as we want to, we thought that would be better done through a larger entity. From day one, we helped build and develop an entire new industry. We’re very proud of that, and this was the continuation of that, as opposed to the end of a chapter.

How did you plan for the exit?

I’ve never planned for an exit. I always just thought about what we can do for the consumer and trying to build a really good business. If you’re the founder of a startup focused on an exit, and that’s all you’re thinking about, those tend to be smaller businesses.

What’s your advice for founders deciding whether to stay private or go public?

If you want to be a big successful company, you kind of have to go public one day. I don’t think that’s going to change, unless you’re a Stripe or a company at the top of a private hierarchy. The public markets are great for instilling discipline into the business. The liquidity for employees is good because they actually get to sell shares right away. You’ve got your quarterlies, your half year, your annual results; there’s a lot of structure and more media attention to it. At the core though, you’re not really running the business that differently.

But something you have to be very proactive and deliberate about when going public is taking the time to explain to employees what the stock market is. There’s a number associated with your company that changes every second. Sometimes that’s good; sometimes it’s hard to explain.

As a founder, you ultimately want to focus on business inputs. If those go well, then the outputs are hopefully positive – and I think about the stock prices as the most abstract output of all. You need to let your people know that some of this is in your control, some of it is not, and to not get too excited either way.

What about UK vs US?

I think there is zero question that the NASDAQ and the NYSE are just more liquid and larger exchanges than the LSE, but I would separate that from how you view the UK as a place to do business. The capital base in the UK is enormous and international. If you have a quality company, you will get financing – I don’t think that’s a problem at all.

To improve the ecosystem here, it’s not about whether the tax rate is X or Y; it’s about which companies have succeeded and whether the employees of those companies have started companies of their own or joined other startups.

We’ve had 80 people start companies out of Deliveroo. There’s an opportunity now, especially with what’s happening in the US, to attract the best people to the UK and build on what’s already been built.

Download the UK Exit 50 to discover the UK’s top startup exits and read more interviews like this one.

All Posts

All Posts