Last updated on July 19, 2023

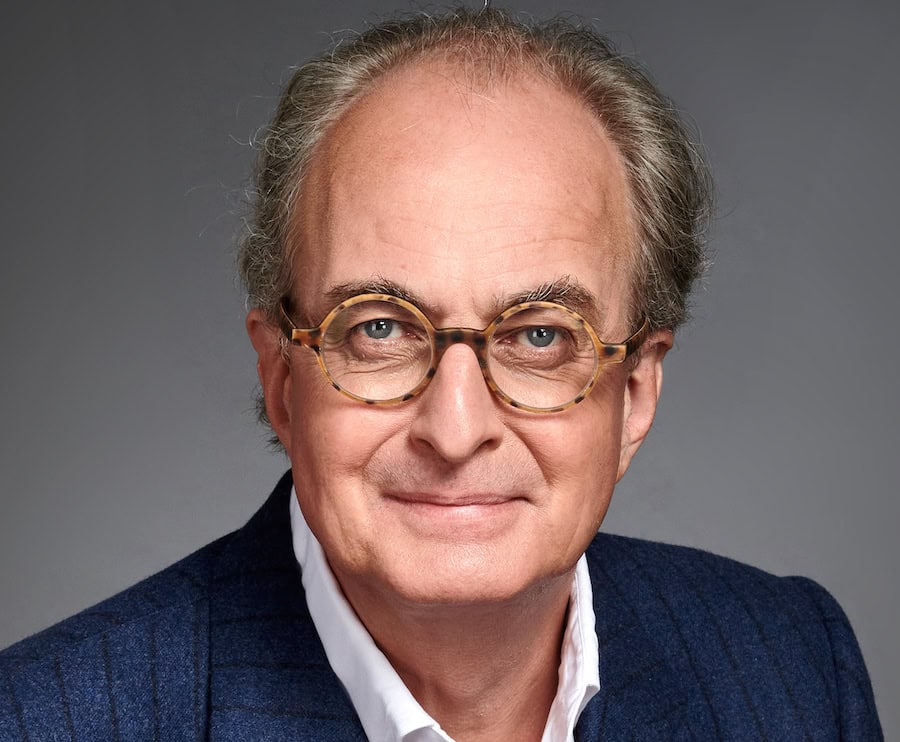

Is your startup ready for investment? Frédéric de Mévius, Executive Chairman & Managing Partner at Planet First Partners, shares his insider advice for climate tech founders.

“Everything we do is at the service of the climate and raising capital to achieve change in the race to net zero,” says Frédéric de Mévius, Executive Chairman & Managing Partner at Planet First Partners.

Frédéric shared his top tips for climate tech founders looking to raise money from investors in our ClimateTech 2023 report.

“The Biggest Step is Productisation.”

Moving from a tech-only business to a great commercial business is just as important as finding the right technology to start with. You need to be able to spot the commercial potential of your tech and then move from managing a team of 10 scientists to hundreds of people in an org chart that’s flexible, agile, and addresses the key challenges of the market.

Move out of the research and development phase, understand your total addressable market and serviceable addressable market, and know how to position your product and service offerings to satisfy your core customers.

“Master Your Technology And Have Scale-Up Potential.”

We look for passion, leadership, your ability to bring people from within and outside your organisation on board with your vision, and organisational skills so you can apply your vision to your organisation.

Our founders have a healthy dose of evangelism in them that we greatly support, but we look for the right mix of a commitment to sustainability and a great business opportunity.

Master technology, build your company around tech that creates a moat for the future, and be prepared to work with us on growing your businesses from €10m in sales to €500m-€1b over time.

“We’re Excited About Hydrogen, But Cautious On Plant-Based Alternatives.”

We’re very excited about alternative materials, proteins, electrification and energy storage, and bio-inputs in agriculture. Hydrogen is also a key pillar of our thinking and will be a huge sector of the future.

One we’re more cautious about at the moment is plant-based alternatives. We like the sector, but there’s still a mismatch between the product offering and consumer expectations. It seems tough to get consumers to make repeat purchases. We need products to improve further for that sector to become exciting again.

“Great Companies Still Have Suitors.”

The current investment environment has rebased valuations, but that doesn’t take away the size of the opportunity in the sustainability space. Instead, the valuation rebasing provides a welcome dose of realism.

What makes Planet First Partners unique is our team, a combination of our strong alignment to sustainability, the people and operational support we give the companies we invest in, and our ecosystem that helps our businesses to thrive.

Inside Planet First Partners

AUM: €450m

Focus: Energy, Farm to Fork, Green Cities, Industry 4.0

Stage: Growth (Series B-C)

Ticket Size: €10m-€30m

Portfolio Includes: Sunfire GmbH, Submer Technologies SL, Eka Ventures II LP

Planet First Partners is a growth equity investment platform that invests in and partners with disruptive entrepreneurs to scale tech-enabled businesses that combine a purpose-driven mission, profitable growth, and a people-centric culture.

Planet First Partners is particularly focused on growth stage companies with proven products and services; current portfolio companies include world-leading industrial green hydrogen electrolysis company Sunfire, and Submer, whose immersion cooling technology is making data centres more sustainable.

Founded in 2020, Planet First Partners is classified as an Article 9 Fund under the EU’s Sustainable Finance Disclosure Regulation, whereby investments are made exclusively in organisations which contribute to an environmental objective or an investment in an economic activity that contributes to a social objective.

Download our ClimateTech 2023 report for more insights from top climate tech founders. Plus, discover the 23 European climate tech startups to watch!

All Posts

All Posts